Tax cuts in the offing

|

|

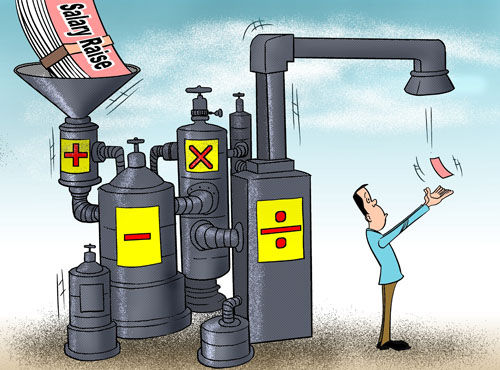

How the system works? [By Jiao Haiyang/China.org.cn] |

According to a recent Economic Observer report, reforms that will lower taxes on medium-to-low incomes and bring tax breaks to the majority of enterprises are key features of the upcoming 12th five-year plan (2011-2015).

The State Administration of Taxation (SAT) draft plan to reduce taxes and redesign the entire tax system signals China's biggest round of tax reforms since 1994.

The Economic Observer quotes two tax officials, one from Jiangsu, the other from Gansu, as admitting that taxes in China are indeed high, and that tax cuts are due.

That China levies high taxes is an acknowledged reality which must change. Statistics show that the central and local tax revenues in 2010 exceeded 12 trillion yuan, the highest ever, and equivalent to one third of the GNP, but a figure that does not include non-tax revenues and arbitrary fee collections. Financial expenditure remains opaque and unspecific.

Public concern over tax has prompted the Ministry of Finance and SAT to formulate an income tax reform scheme set to be launched in 2011. Reforms will not, as publicly hoped and expected, raise the tax floor. There are plans instead to reduce to six-or-seven the present nine income tax levels and to expand each bracket. Cutting tax levels has a more obvious effect than adjusting the tax threshold because it is equivalent to reducing rates of taxation.

Tax cuts that result in higher incomes compare in effect to "adding water to raise fish". Experts and officials, moreover, are reportedly confident that tax cuts will not diminish China's tax income, but rather nurture a more lucrative source of tax revenue through an economically revitalized public. The key factor is whether or not China's tax reforms are abreast of the times.

0

0